Many are afraid to take the leap to simply find out what their credit score is. Opening the door and learning whether you have a good score, or need to work on it is a very important first move.

Let’s start with the basics. What do the number ranges mean?

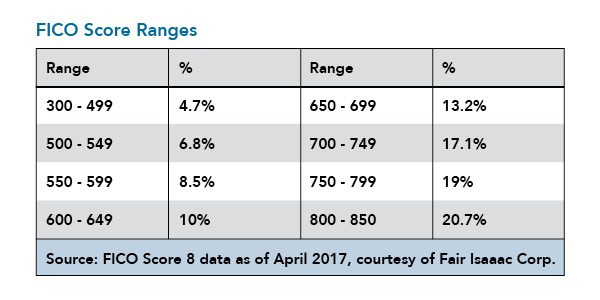

The most common credit score models have a range from 300 to 850. The higher your score is, the better! If your score is 300, that’s bad and if you have 720 and up, that’s excellent. Recent data from April 2017, courtesy of Fair Isaac Corp., showed that the average FICO score was 700. See below chart for the whole breakdown.

Even if your credit score is below 500, you may still be approved for credit cards. Your interest rate will just be higher. Consequently, you may also pay more for insurance or have to put a deposit down for utilities. As your score increases, you will have improved credit options and pay less to use them. A person with a credit score 750 or higher are likely to get 0% on interest rates for credit and car financing.