Evansburg Credit Report Error Attorney: Protect Your Credit and Financial Future

Vullings Law Group, LLC

Get a Free Case Review

Don't Let Credit Report Mistakes Impact Your Financial Stability in Evansburg

Did you know that nearly one-third of Americans have inaccuracies on their credit reports? Alarmingly, 20% of Americans face errors significant enough to affect their credit ratings, leading to rejections for new credit or refinancing existing loans. Such errors can cause undue financial strain, impacting your chances of maintaining employment, acquiring new credit, securing auto loans, or even obtaining insurance.

At Vullings Law Group, LLC, we recognize the critical role of an impeccable credit history. Our team of seasoned credit attorneys specializes in cases related to the Fair Credit Reporting Act (FCRA) and is equipped to help you challenge creditors and consumer reporting agencies that report errors on your credit file.

Common Credit Dispute Question:

Question: How long does a credit dispute take?

Answer: The duration of a credit dispute can vary, but it generally takes around 30 to 45 days for credit reporting agencies to investigate and respond.

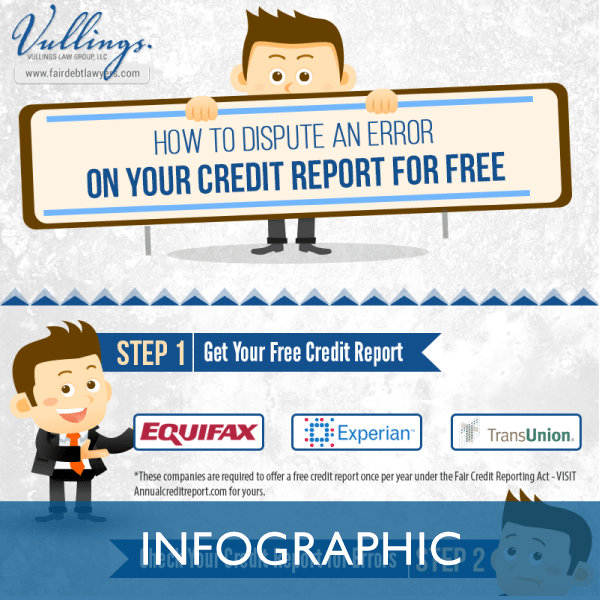

Access Your Free Credit Report Now

You might think that getting a free credit report is redundant if you're already familiar with its content. However, over a quarter of U.S. residents have errors on their credit reports that negatively affect their credit scores. This makes it crucial to review your report and confirm its accuracy, which is the first step in identifying and resolving any potential issues.

Be cautious! Not all websites that offer free credit reports are reliable. Some aim to steal sensitive details like names, addresses, and social security numbers. Thankfully, AnnualCreditReport.com is a trustworthy source for free annual credit reports, endorsed by the Federal Trade Commission.

Always verify the URL to ensure it reads AnnualCreditReport.com to avoid falling prey to scam websites with similar but misspelled URLs.

How to Examine Your Credit Report

Once you receive your credit report, follow these steps for a comprehensive review:

- Confirm your basic personal details, especially if you've recently relocated, switched jobs, or changed your name.

- Validate each credit account to ensure you actually opened them.

- Cross-reference the amount due on each account with recent statements from your banks or creditors.

- Scrutinize any incorrect payment data, making sure that missed or overdue payments haven't been wrongly reported.

- Be alert to credit inquiries from unfamiliar companies, as this could signal attempted identity theft.

- Review any listed judgments, bankruptcies, and foreclosures, ensuring their dates are accurate as they will eventually be removed.

Safeguard your credit and fortify your financial future with Evansburg's local expert Credit Report Attorneys. Contact us today for a free consultation at 1-855-324-7263 or complete the contact form on this page.

Philadelphia Resources:

Montgomery County Credit Unions - While not local to Evansburg, this list of Credit Unions in Montgomery County will provide credit services.

Consumer Credit Counseling Services - The Consumer Credit Counseling Services of Northeastern PA or CCCS offers counseling, management, and education services regarding credit.

Credit Counseling Center - The Credit Counseling Center offers local courses and counseling to help you manage your credit.